LTC Price Prediction: Bullish Momentum Targets $124-131 by October 2025

#LTC

- Technical indicators show LTC trading above key moving averages with bullish momentum

- Fundamental catalysts include whale accumulation and institutional adoption developments

- Price targets project potential movement to $124-131 range by October 2025

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

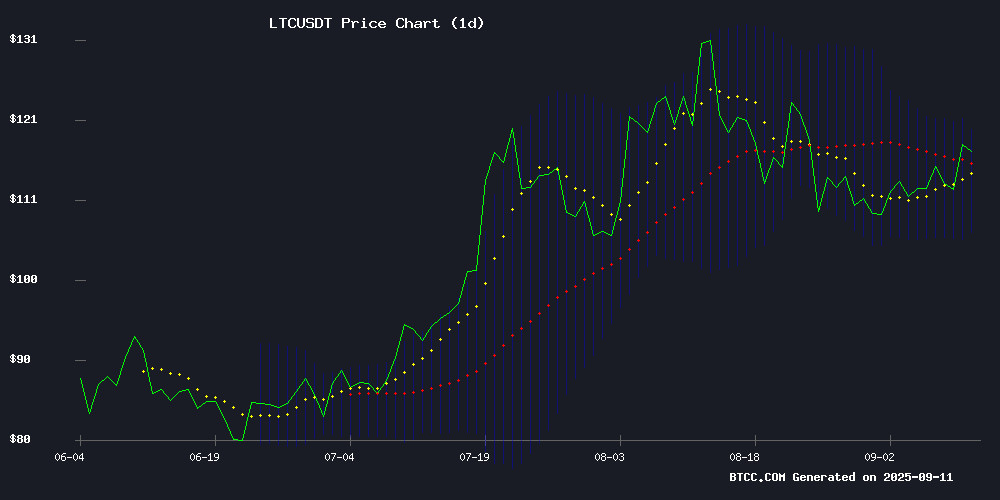

Litecoin is currently trading at $116.88, comfortably above its 20-day moving average of $113.03, indicating sustained bullish momentum. The MACD reading of 1.88 suggests positive momentum, though the negative histogram value of -1.87 warrants monitoring for potential consolidation. Price action NEAR the upper Bollinger Band at $119.55 suggests LTC is testing resistance levels, with support established at $106.51.

According to BTCC financial analyst Emma, 'The technical setup favors continued upward movement, with a break above $120 potentially triggering further gains toward the $124-131 target range mentioned in recent predictions.'

Market Sentiment: Strong Fundamentals Support LTC's Bullish Outlook

Recent developments including whale accumulation, ETF-related buzz, and historic adoption by a U.S.-listed company as a primary reserve asset are creating positive sentiment around Litecoin. The SEC's delayed decisions on various crypto ETFs, while creating short-term uncertainty, maintain anticipation for broader institutional adoption.

BTCC financial analyst Emma notes, 'The combination of technical strength and fundamental catalysts positions LTC favorably. The $135 breakout level that traders are watching aligns with the current technical trajectory and positive news flow.'

Factors Influencing LTC's Price

Why is Litecoin (LTC) Price Up Today?

Litecoin surged 5.5% amid bullish institutional interest, outpacing most altcoins. Grayscale's filing for a Litecoin ETF injected fresh optimism, mirroring its earlier Bitcoin and Ethereum ETF efforts.

Whale accumulation patterns suggest deepening conviction in LTC's fundamentals. The token now trades at $116.74, with trading volume exceeding $734 million as network activity intensifies.

Litecoin’s Bullish Trend Holds as Traders Eye $135 Breakout

Litecoin (LTC) trades at $114.88, marking a 0.99% gain over the past 24 hours despite a 13.45% drop in trading volume. The coin has risen 2.13% this week, demonstrating resilience amid fluctuating market conditions. Analysts note its ability to hold key support levels, with the $112–$115 demand zone acting as a foundation for potential upward movement.

Technical indicators paint a cautiously optimistic picture. The RSI at 52.61 suggests neutrality, while the MACD hints at budding bullish momentum. LTC remains above the 9 EMA ($112.68) and 50 SMA ($115.25), with these moving averages serving as dynamic support. A sustained position above $112 could propel prices toward the $120–$125 range, with $135 emerging as the next significant target. Conversely, a drop below $110 would invalidate the current bullish structure.

SEC Delays Grayscale's Hedera and Bitwise's Dogecoin ETF Decisions to November 2025

The U.S. Securities and Exchange Commission has pushed back its rulings on Grayscale's Hedera ETF and Bitwise's Dogecoin ETF to November 12, 2025. The move reflects the regulator's cautious approach as it reviews over 90 pending crypto ETF applications, including proposals for Solana, XRP, Avalanche, and BNB.

Grayscale is aggressively expanding its ETF offerings, filing to convert its Bitcoin Cash and Litecoin Trusts into ETFs while submitting a new S-1 registration for a Hedera ETF. The filings, backed by Bank of New York Mellon as custodian, signal growing institutional interest in altcoin investment vehicles.

Market participants note the SEC continues to utilize its full review period rather than issuing early decisions. This pattern suggests a deliberate, if frustrating, regulatory pace as the agency grapples with the complexities of crypto-based financial products.

Litecoin (LTC) Shows Bullish Momentum Amid Market Fluctuations

Litecoin (LTC) is carving a distinct path upward today, defying broader market volatility. Trading at $114.41 with a 2.92% gain over 24 hours, the 'silver to Bitcoin's gold' boasts an $8.72 billion market cap and $483.22 million in daily volume. Technical indicators paint a conflicted picture: while the Moving Average suggests bearish pressure at $115.1, the MACD's bullish crossover hints at underlying strength.

The cryptocurrency now tests a critical resistance at $115.51—a breakout could propel LTC toward $120, while failure risks a retreat to $110 support. Coincodex maintains a bullish September forecast, echoing the optimism reflected in LTC's outperformance against fluctuating peers. Market watchers note the altcoin's resilience as it navigates conflicting technical signals in a turbulent crypto landscape.

LTC Price Prediction: Targeting $124-131 by October 2025 as Bullish Momentum Builds

Litecoin (LTC) shows strong bullish signals with a current price of $116.86, up 3.96% daily. Technical indicators, including a bullish MACD histogram, suggest a potential 6-12% rise to the $124-131 range within four weeks.

Analyst consensus aligns around medium-term targets, with CoinDataFlow projecting $131.96 and BTCC forecasting $131-155 by October 2025. Immediate support sits at $106.38, while the upper Bollinger Band at $119.54 hints at near-term resistance.

The $124-155 zone emerges as a focal point for October, backed by robust market sentiment. Litecoin's resilience positions it for sustained upward movement, mirroring broader crypto market optimism.

Litecoin (LTC) Price Prediction: Retest of $115 Sets Stage for Bullish Breakout

Litecoin surges toward key resistance levels as bullish momentum builds, fueled by technical strength and fundamental developments. The cryptocurrency has weathered market volatility with notable resilience, drawing attention from traders anticipating further upside.

A privacy-focused wallet launch marks a significant milestone for Litecoin's ecosystem. The Litecoin Foundation's partnership with AmericanFortress introduces MimbleWimble Extension Blocks technology, enabling confidential transactions while maintaining regulatory compliance. "This balances user expectations with compliance needs," a Foundation spokesperson noted, highlighting the wallet's potential to drive long-term adoption.

Network fundamentals continue strengthening, with record hashrates signaling robust miner participation. The upcoming beta release of the privacy wallet later this month could provide additional catalysts for LTC's price trajectory as institutional interest grows.

SEC Delays Grayscale Hedera Trust Decision Amid Crypto ETF Surge

The U.S. Securities and Exchange Commission has pushed its review deadline for Grayscale's proposed Hedera Trust to November 2025, signaling cautious regulatory scrutiny as crypto ETF applications flood in. The trust, which would trade as HBAR, awaits Nasdaq's rule-change approval for listing.

Grayscale simultaneously updated filings for its Bitcoin Cash and Litecoin Trusts, both targeting NYSE Arca listings. Bank of New York Mellon serves as administrator while Coinbase provides custody—a structure mirroring institutional-grade compliance frameworks seen in traditional finance.

These developments occur against a backdrop of mounting ETF applications, including products tied to Solana and XRP. The SEC's measured pace reflects both procedural norms and the complex evaluation required for novel digital asset vehicles.

Litecoin Surges 5% as Whale Accumulation and ETF Buzz Catalyze Breakout

Litecoin price rallied past $118 on September 10, 2025, marking a 5% gain as whale activity and ETF speculation fueled demand. The cryptocurrency breached key resistance levels after weeks of consolidation, outperforming most large-cap altcoins.

On-chain data reveals wallets holding 1,000+ LTC added 181,000 coins in a single day. This accumulation spike coincided with two bullish developments: Grayscale's ETF filing and MEI Pharma's $100 million treasury allocation to Litecoin. Market observers note the move reflects growing institutional interest in Proof-of-Work assets beyond Bitcoin.

The breakout comes three weeks after Litecoin weathered a broader market downturn. Trading volumes surged 40% above the 30-day average, with Binance and Coinbase accounting for nearly 60% of spot transactions. Derivatives open interest climbed to $450 million, suggesting leveraged bets on continued momentum.

10 Jaw-Dropping Blockchain ETFs for Explosive Growth Opportunities

The digital transformation fueled by blockchain technology is reshaping industries far beyond cryptocurrencies. While Bitcoin and Ethereum dominate headlines, institutional adoption of blockchain infrastructure and applications is accelerating. Savvy investors are bypassing direct crypto exposure in favor of regulated blockchain ETFs, which offer strategic access to companies driving this innovation.

These funds target everything from enterprise blockchain solutions to decentralized finance protocols. The sector's growth reflects widening real-world adoption—financial institutions now use distributed ledgers for settlement, while supply chains leverage immutability for provenance tracking. Yet risks remain: regulatory uncertainty and technological hurdles could temper returns.

SEC Delays Decision on Franklin Templeton's Spot Solana ETF

The U.S. Securities and Exchange Commission has deferred its ruling on Franklin Templeton's proposed spot Solana ETF, pushing the final deadline to November 14, 2025. The move aligns with the regulator's pattern of postponing decisions on crypto-related ETFs, including those for Litecoin and XRP.

Analysts anticipate a wave of approvals in October, as the SEC reviews over 90 cryptocurrency ETF applications. The agency's cautious approach reflects ongoing scrutiny of digital asset markets, despite growing institutional interest.

Litecoin Makes History as First U.S.-Listed Company Adopts LTC as Primary Reserve Asset

MEI Pharma, now rebranded as Lite Strategy, has committed $100 million to Litecoin (LTC) in a groundbreaking corporate treasury move. The Nasdaq-listed firm becomes the first U.S. public company to designate a cryptocurrency other than Bitcoin as its primary reserve asset.

Charlie Lee, Litecoin's creator and Lite Strategy board member, orchestrated the acquisition through partnerships with Titan Partners and GSR. The decision highlights LTC's institutional appeal—its 12-year uptime record, predictable fixed supply, and negligible transaction fees outperforming larger-cap alternatives.

The treasury bet signals growing confidence in Litecoin's role as a payments rail. With potential ETF applications looming, Lite Strategy positions itself as an institutional gateway for LTC adoption. Lee emphasizes the cryptocurrency's retail integration and settlement efficiency as key differentiators against stablecoins and smart contract platforms.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity. The price trading above key moving averages, combined with positive fundamental catalysts, suggests continued upward potential.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $116.88 | Bullish |

| 20-day MA | $113.03 | Support Level |

| MACD | 1.88 | Positive Momentum |

| Bollinger Upper | $119.55 | Resistance Test |

With target projections of $124-131 by October 2025 and strong institutional interest, LTC appears well-positioned for medium-term growth.